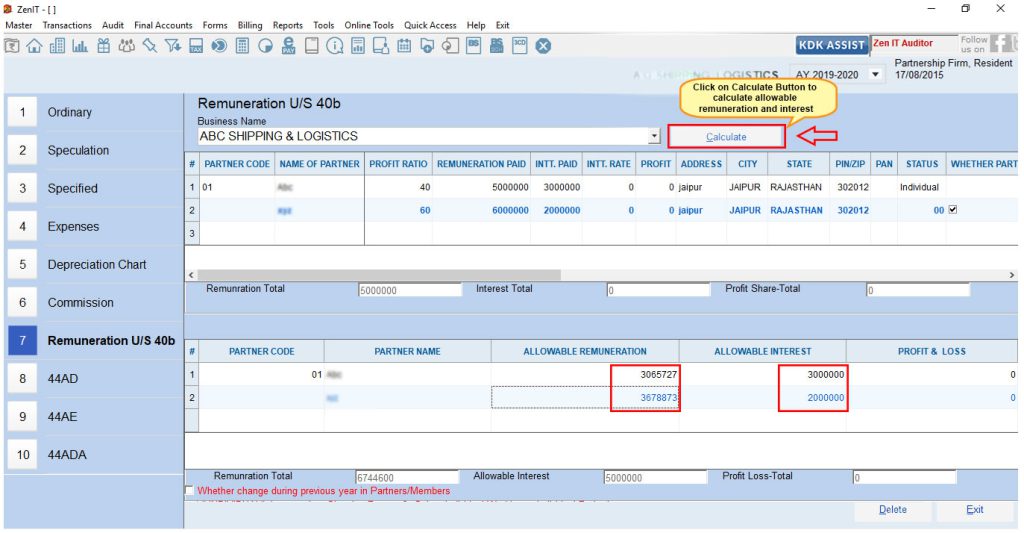

Remuneration and Interest to Partner – Section 40(b) using IT

The process to enter disallowed partner’s interest and remuneration as per section 40 in Part OI Point no 8A h. “Amount of interest salary, bonus, commission or remuneration paid to any partner or member” As per section 40(b)(v) any payment of remuneration to any partner who is a working partner, authorized by, and is in […]