Your Step-by-Step Guide to Migrate to Spectrum Cloud Without Losing Data

The tax and compliance landscape in India is transforming faster than ever. With frequent portal updates, stricter deadlines, and increasing data volumes, CA firms and tax professionals are under constant pressure to deliver accuracy, speed, and security – all at once.

Traditional desktop software, though reliable in the past, can no longer keep up with the modern pace of compliance. Files are scattered across systems, backups are inconsistent, and team coordination becomes challenging when multiple users work on different machines. The result? Wasted hours, version conflicts, and a constant fear of data loss during transitions.

That’s why leading firms are now moving to cloud-based compliance platforms – solutions that centralize ITR, TDS, and GST workflows, automate data fetching, and keep every client file secure in one unified system.

Spectrum Cloud, is one such next-generation platform – designed specifically for CAs and tax professionals who file for unlimited clients and want to migrate from any existing software without losing even a single byte of data.

This step-by-step guide walks you through everything you need to know to migrate confidently – from pre-migration planning and data mapping and final go-live – ensuring a zero-data-loss transition for your firm.

1. Why Migration Matters: The Strategic Case for CA Firms

For most Chartered Accountants, tax season feels like a race against time. Between ITR filings, TDS returns, GST reconciliations, and client follow-ups, managing hundreds of clients with multiple software systems can easily spiral into chaos. Data duplication, missing attachments, version mismatches, and manual reconciliations drain productivity and increase risk – especially when teams are distributed or working remotely.

Migrating to Spectrum Cloud isn’t just a technology shift; it’s a strategic decision to future-proof your practice. Cloud platforms centralize every compliance task – ITR, TDS, GST, e-filing, and client communication – into one secure, collaborative workspace. Instead of juggling multiple tools, teams can log in from anywhere, access real-time client data, and file returns faster with automated validations and backups.

Migrating to the cloud ensures:

- Seamless ITR, TDS, and GST operations from anywhere

- Automatic backups and multi-user collaboration

- Zero downtime during filing deadlines

- Secure, government-grade data encryption

Spectrum Cloud brings together decades of tax expertise with the flexibility of cloud technology. Migration isn’t just a technical shift – it’s a strategic upgrade for scalability, data continuity, and efficiency.

2. Preparing for Migration: The Pre-Migration Checklist

Successful migration starts long before the first file is uploaded. The key is preparation – knowing what data you have, where it lives, and how it will move. A clear pre-migration plan ensures a smooth transition to Spectrum Cloud without losing critical information or disrupting your ongoing compliance work.

1. Audit Your Current Systems

Begin by listing every tool your firm currently uses for ITR, TDS, and GST filing – including legacy desktop software, spreadsheets, or third-party portals.

Create an inventory of:

- Client databases (PAN, GSTIN, contact info)

- Filing data (returns, challans, audit reports)

- Digital signatures, certificates, and tokens

- Supporting files (invoices, attachments, POAs, etc.)

This inventory becomes your “migration map” – it tells you exactly what needs to move and what can be archived.

2. Consolidate and Clean Your Data

Before export, ensure your data is consistent, standardized, and error-free.

- Remove duplicate or inactive client entries.

- Verify GSTINs, PANs, and e-mail IDs.

- Ensure all invoices and documents are properly named and stored in structured folders.

- Reconcile ledgers in Tally or your accounting system before migration.

Clean data ensures faster imports and zero mismatches later.

3. Back Up Everything

Before migration, take a full backup of your existing software and client folders – either on a secure local drive or encrypted cloud storage.

If you’re using multiple systems, create labeled folders by client or financial year for easy reference.

Remember: A verified backup is your safety net during the transition.

4. Prepare a Rollback Plan

Even the best migrations need a backup strategy. Keep your old software operational for at least 30 days post-migration in case you need to refer to historical data or revert any client file.

By completing this checklist, your firm builds a solid foundation for a seamless and secure move to Spectrum Cloud – with zero risk of data loss and minimal downtime.

3. Step-by-Step Migration Process: From Old Software to Spectrum Cloud

Migrating to a new compliance platform often sounds daunting – especially when you’re managing hundreds of clients and years of financial data. But with Spectrum Cloud, the transition is designed to be intuitive, automated, and error-free. Whether you’re currently using desktop-based software or another online filing tool, you can migrate effortlessly without losing a single data point.

Here’s how the process works – step by step.

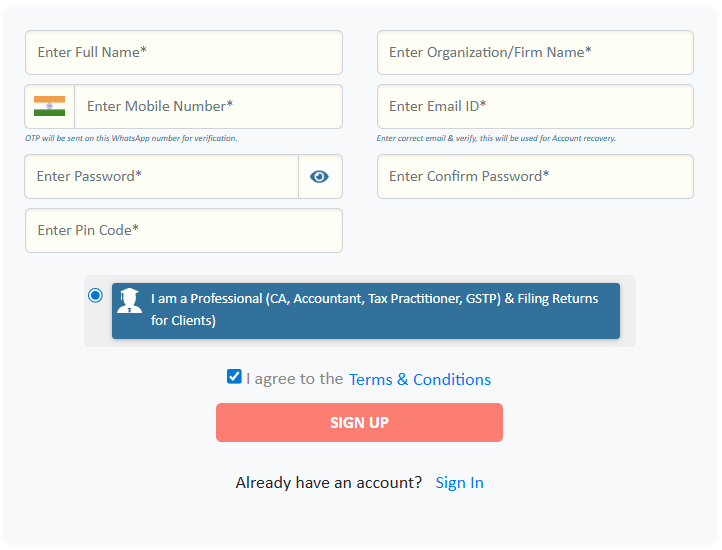

Step 1: Create Your Account

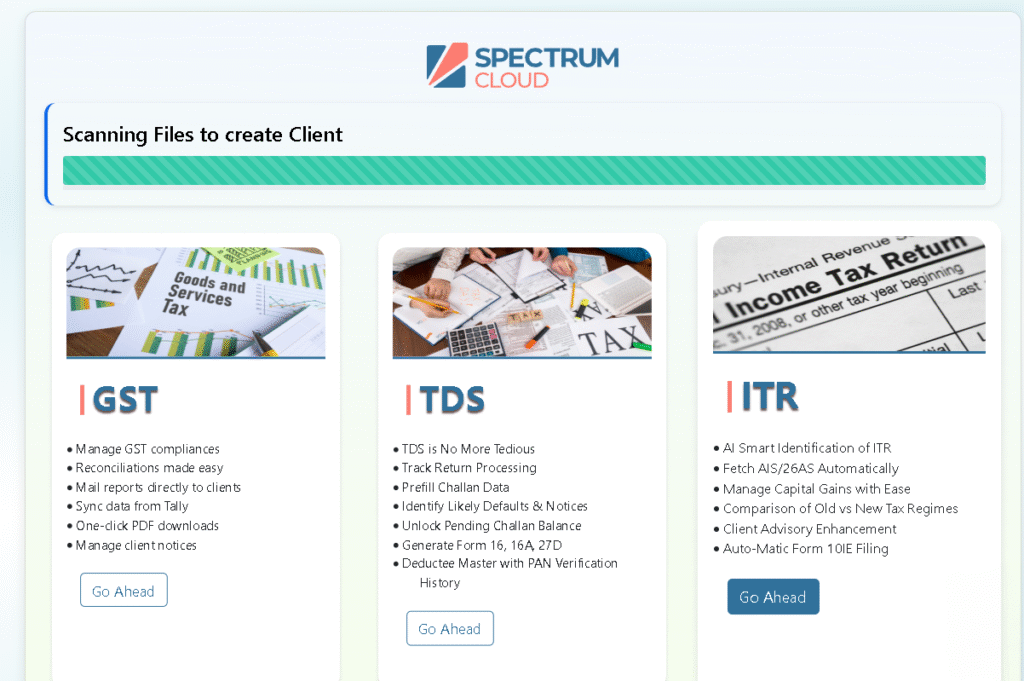

Get started by signing up for Spectrum Cloud in just a few clicks. Once registered, you’ll have access to a secure, cloud-based workspace where you can manage ITR, TDS, and GST filings under one roof.

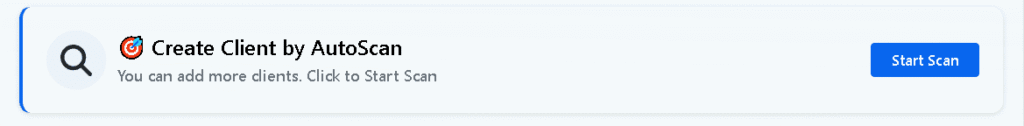

Step 2: Auto Scan & Import Data

No manual uploads. No chaos. Spectrum Cloud’s Auto Scan feature automatically reads and imports all client data from your existing software – including ITR master data, GST reports, and TDS statements.

The system intelligently detects file formats and maps your data fields for you. Whether your records are in Excel, JSON, or exported ZIP files, Spectrum Cloud ensures a smooth import.

Step 3: Review & Process

Once the import is complete, your client data appears neatly structured – ready for review. You can cross-check, validate, and begin filing immediately.

Spectrum Cloud supports unlimited client filing, enabling your team to work collaboratively on multiple cases without worrying about local storage, version control, or data duplication.

4. Common Challenges in Migration (and How Spectrum Cloud Solves Them)

For most CA firms, the thought of switching software brings one major concern – what if something breaks? Over years of using traditional or third-party tax solutions, firms build massive client databases, custom templates, and filing records. Migrating all that data to a new system feels risky – and time-consuming.

Let’s break down the most common migration challenges and how Spectrum Cloud turns each one into a smooth, automated experience.

Challenge 1: Fear of Data Loss

CAs often worry about missing files, incomplete client details, or lost filing histories during migration.

Spectrum Cloud Solution: The platform uses intelligent data mapping and checksum verification to ensure every single record – from PAN to past filings – transfers securely. Not a byte is left behind.

Challenge 2: Format Compatibility

Most legacy tools export data in unique file structures that aren’t easily readable elsewhere.

Spectrum Cloud Solution: The Auto Scan Engine supports multiple formats – Excel, JSON, CSV, and system backups – and automatically adapts imported data to Spectrum’s format. You don’t need to manually clean or reformat anything.

Challenge 3: Team Coordination

When multiple team members are involved in migration, things can get confusing – different versions, duplicates, and data conflicts.

Spectrum Cloud Solution: With real-time multi-user access, your entire team works on the same cloud dashboard, ensuring consistency and collaboration. No manual version control, no file sharing chaos.

Challenge 4: Downtime During Transition

Many firms fear losing productivity while setting up the new system.

Spectrum Cloud Solution: Migration happens in parallel – meaning you can continue working on your old system while your data is being imported in the background. No downtime, no disruption.

Challenge 5: Security & Compliance Risks

Migrating sensitive tax and financial data requires a platform that’s not just efficient, but compliant with Indian IT and data protection norms.

Spectrum Cloud Solution: Every migration is 256-bit encrypted, hosted on secure Indian cloud servers, and compliant with ISO 27001 standards – ensuring end-to-end protection of your firm’s data.

4. What You Gain with Spectrum Cloud: Key Features Built for CAs & Tax Professionals

Migrating to Spectrum Cloud isn’t just about moving data – it’s about transforming how your firm operates.

Spectrum Cloud empowers Tax practitioners to manage ITR, TDS, and GST filings faster, more securely, and from anywhere.

Here’s what makes it the ultimate compliance platform for professionals who file for unlimited clients.

1. All-in-One Compliance Dashboard

Access all your compliance modules – Income Tax, TDS, and GST – from a single, unified workspace.

Say goodbye to juggling between tools or maintaining multiple installations.

With Spectrum Cloud, your entire team can view, edit, and manage all client data in one secure dashboard.

Benefit: No switching tabs. No fragmented data. Just one platform that connects your entire workflow.

2. Auto Data Sync from Tally & GST Portal

Spectrum Cloud offers Tally Auto Sync and direct GST portal integration, helping you fetch and reconcile data seamlessly.

You can import 7 years of historical data in seconds, track notices, and view all client compliance statuses in real time – without manual downloads.

Benefit: Save hours of repetitive work with instant reconciliation and live compliance tracking.

3. Unlimited Clients. Zero Downtime.

Unlike other platforms that restrict the number of filings or charge per client, Spectrum Cloud is built for scalability.

Whether your firm manages 50 or 5,000 clients, the system stays fast, stable, and reliable – even during peak filing seasons.

Benefit: Grow your client base freely without worrying about software limits or performance drops.

4. Enterprise-Grade Security & Data Encryption

Your data is protected by AES 256-bit encryption, secure login authentication, and automatic cloud backups.

Every file, from ITR reports to GST returns, is stored securely with end-to-end encryption – meeting Indian IT and data protection standards.

Benefit: File confidently knowing your client data is safe and compliant.

5. Seamless Collaboration for CA Teams

Spectrum Cloud is built for multi-user, real-time collaboration.

Assign roles, track progress, and monitor filings across your firm from a single dashboard.

Your team can log in from any device, review client data simultaneously, and stay aligned – wherever they are.

Benefit: Simplify team coordination and boost productivity across multiple locations.

6. Smart Filing Tools for ITR, GST & TDS

From bulk PAN validation to auto ITC reconciliation and error-free TDS return filing, Spectrum Cloud brings advanced automations that minimize manual intervention.

Integrated audit trails and validation checks ensure every return is accurate before submission.

Benefit: File faster, reduce rejections, and stay fully compliant with the latest Income Tax and GST rules.

7. 24×7 Cloud Accessibility

Work securely from anywhere – whether you’re at your office, home, or client site.

All updates are automatic; no installations or version upgrades required.

Benefit: Stay productive during peak deadlines without worrying about outdated software or version conflicts.

8. Future-Ready Infrastructure

Spectrum Cloud continuously evolves with regulatory changes, AI-based compliance insights, and new automation features.

Your firm is always ahead – without having to migrate again.

Benefit: Future-proof your practice with technology that scales as you grow.

5. ROI of Cloud Migration for CA Firms

Migrating to Spectrum Cloud isn’t just about modernizing – it’s about measurable efficiency.

- Time saved: up to 50% in data entry & verification

- Reduced IT maintenance: no installations or updates

- Zero downtime: automatic cloud updates

- Improved collaboration: clients & teams on the same system

Firms that have already migrated report improved turnaround times, faster team coordination, and fewer last-minute compliance errors.

ROI Calculator for CAs

(Estimate how much you can save with Spectrum Cloud)

💰 Calculate Your Firm’s ROI After Migration

Estimate your annual time & cost savings after moving to Spectrum Cloud.

💡 On average, firms save 35–50% filing time using Spectrum Cloud.

6. Why Choose Spectrum Cloud Over Others?

| Feature | Spectrum Cloud | Typical Tax Software |

|---|---|---|

| Unlimited Filing | ✅ Unlimited Clients | 🚫 Limited Plans |

| Cloud Access | ✅ Anytime, Anywhere | 🚫 Desktop Only |

| GST + TDS + ITR Integration | ✅ Unified | 🚫 Separate Tools |

| Migration Support | ✅ Assisted & Automated | 🚫 Manual Upload |

| ROI Tracking | ✅ Built-In Calculator | 🚫 No Insight |

| Pricing | 💰 Affordable Plans | 💸 Costly Subscriptions |

Conclusion: Migrate Smarter, File Faster, and Grow Limitlessly with Spectrum Cloud

Migrating to the cloud isn’t just a tech upgrade – it’s a strategic move to future-proof your CA firm. With compliance workloads increasing and client expectations evolving, staying on legacy or disconnected systems can hold your practice back. The right cloud platform not only simplifies migration but also enhances every aspect of your operations – from accuracy and collaboration to scalability and client satisfaction.

Spectrum Cloud makes this transition effortless. Whether you’re moving from desktop software or any other tax platform, its automated data migration, real-time access, Tally sync, and all-in-one compliance dashboard ensure a zero-data-loss experience. You can file ITR, GST, and TDS for unlimited clients – anytime, anywhere – with enterprise-grade security and zero downtime.

Firms across India are already transforming how they work – cutting manual hours, improving ROI, and scaling their compliance capabilities with Spectrum Cloud. If you’re ready to do the same, the time to migrate is now.

👉 Take the next step today – experience seamless, secure, and scalable compliance with Spectrum Cloud. Migrate to Spectrum Cloud →

FAQs

Yes. Spectrum Cloud uses AES 256-bit encryption, ISO 27001-certified servers, and Indian data residency for maximum compliance and security.

Most firms complete the migration within 5–7 days, depending on data volume and number of clients.

Yes, Spectrum Cloud supports module-wise migration (GST, TDS, ITR) as per your firm’s workflow.

No. The process is 100% loss-free, with automated verification and reconciliation before go-live.

Absolutely. You can auto-sync ledgers, vouchers, and trial balances using Tally Auto Sync.

It remains safe. You’ll have complete local backups and full continuity on Spectrum Cloud.

Yes. Spectrum Cloud allows real-time collaboration with role-based access and activity tracking.

Yes, you get dedicated onboarding assistance via remote support and guided walkthroughs.

Yes. You can log in securely via any device browser – no installation required.

Spectrum Cloud offers unlimited client filing, multi-module integration (ITR, TDS, GST), faster data fetch, and Indian server-based data protection, unlike others that limit users or charge extra per client.