Recently Major amendments came into effect from 1st October 2022 vide Notification dated 28th September 2022.

A taxpayer is not permitted to file GSTR-1 under section 37(4) of the CGST Act if a previous GSTR-1 has not been submitted, and under section 39(10), a taxpayer is not permitted to submit GSTR-3B if a GSTR-1 for the same tax period has not been submitted on the due date.

In simple Words, If the taxpayer has not complied with GSTR1 Due Date then he is barred from filing the Subsequent GSTR3B of that particular period and GSTR1 of immediately preceding next tax period, so complying to the GSTR1 Due date has become very Important to avoid Late fees.

The Due date for GSTR-1 is based on turnover. Businesses with up to Rs 5 crore in sales can choose to submit their quarterly returns under the QRMP scheme, which are due on the 13th month after the relevant quarter.

In addition, Taxpayers who do not select the QRMP policy or who have a turnover of more than Rs 5 Cr. are required to submit their returns each month by the 11th of the next month, at the latest.

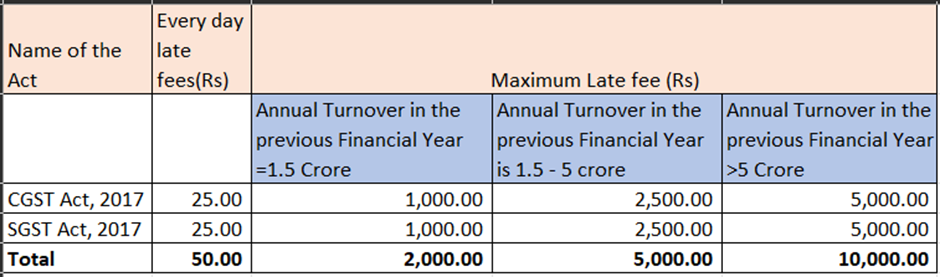

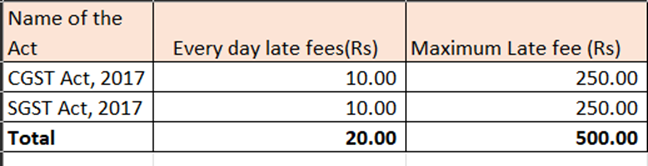

Taxpayers will be charged with Late fees of Rs. 200 per Day (Rs. 100 for CGST and Rs. 100 for SGST) for failing to furnish the GSTR1 on due date

However, following the notices sent up until February 2021, the late fees will continue to be assessed at a significantly reduced rate of Rs. 50 per day and Rs. 20 per day for nil returns. Keep in mind that the GSTR-1 late charge will no longer be sought in the GST portal as part of the payment challan in PMT-06 at the time the GSTR-3B is submitted.

Taxpayers have started receiving the notice amounting as huge as Rs 200000.

CBIC had reminded of Late Fees for Non Filing of GSTR-1 on Due date before the due date of Tax period October i.e 11th November.

It is said by Tax experts that this move of the Government is to make Taxpayers more compliant of GST Tax laws.