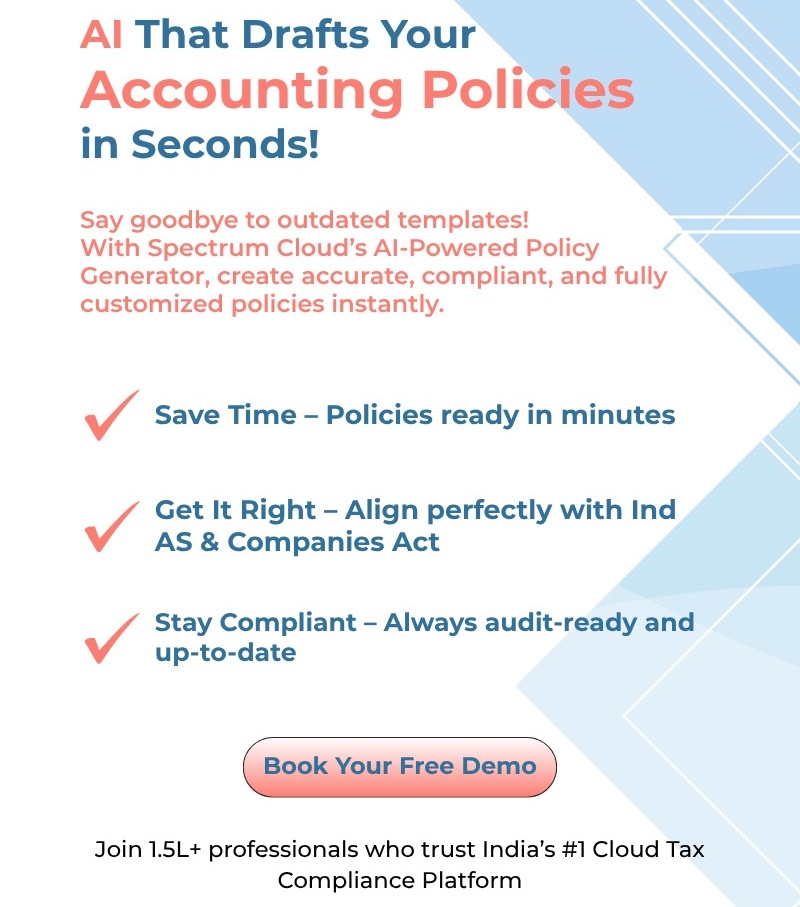

Why CAs & Tax Firms Choose Spectrum Cloud as TDS Filing Software

Spectrum Cloud is known as the best software for TDS return filing, with automated FVU generation and seamless TRACES integration with Form 16 generation and Email. It's trusted by CAs nationwide to make TDS compliance for multiple clients seamless and easy.

Auto TRACES Fetch

Smart Error Alerts

Smart Interest Allocation

TDS Health Dashboard

Unlimited Clients

Enterprise‑Grade Security

Manage Notices and Orders

Speed & Efficiency

Stay ahead with instant data fetch, bulk PAN verification, and lightning-fast master creation.

Smart Compliance Management

Prevent defaults and errors with automated checks

Reports & Certificates

Generate professional reports and certificates instantly for complete transparency.

User Experience & Convenience

Work smarter with multi-client dashboards and simple, cloud-based navigation.

Filing Process - As Easy As 1-2-3

Export Pre-Filled Template

Get a ready-to-use Excel template with all mandatory fields pre-filled.

Add Deductee Transactions & Import

Update or add deductee details and re-import.

Generate FVU & E-File

Instantly generate FVU, file returns online, and receive acknowledgements.

Enterprise‑Grade Security You Can Trust

SSL Encryption

Protects your data with bank-level SSL encryption, ensuring safe transmission and secure web access at all times.

ISO 27001 Certified Storage

All data is stored in ISO 27001-compliant servers, giving your firm the same protection trusted by global enterprises.

Regular Security Audits

We run continuous audits and vulnerability testing to stay ahead of evolving threats and keep your data airtight.

2-Factor Authentication (2FA)

Add a second layer of login protection to block unauthorized access and keep your client data in safe hands.

Your TDS data is sensitive - we protect it with the same level of security trusted by leading banks and enterprises

Here Is Our Testimonials to Success

Frequently Asked Questions

Spectrum Cloud TDS is a cloud-based TDS filing software designed for Chartered Accountants, tax professionals, and enterprises managing multiple TANs. It simplifies unlimited return filing, reconciliation, and compliance.

You can manually log in to the TRACES portal, download challans, fill forms, and submit FVU files. Spectrum Cloud automates all these steps, saving time and preventing errors.

Yes. Spectrum Cloud allows multi-client and multi-TAN management from a single dashboard without repeatedly logging into TRACES.

Yes. You can import existing client lists, deductee transactions, and challan data via Excel or supported accounting software.

Smart validation checks for invalid PANs, wrong section codes, mismatched challans, and interest allocation issues before filing, minimizing default notices.

Absolutely. The software allows bulk generation, signing, and emailing of Form 16/16A certificates instantly.

All data is protected with bank-level SSL encryption, ISO-certified cloud hosting, role-based access, and automatic backups, ensuring full compliance with Indian IT laws.

Yes. Real-time dashboards display challan usage, remaining balances, and mismatches with TRACES, helping you stay compliant.

Spectrum Cloud automates import, reconciliation, and FVU generation, allowing unlimited TDS filing in minutes, even for hundreds of clients.

Yes. Being fully cloud-based, you can securely access and manage all TDS filings from your office, home, or on the go.

File TDS Smarter. File TDS Right.

Join thousands of CAs and tax professionals using the best cloud TDS software for fast, accurate, and secure compliance.